Even so, your co-signer or co-borrower might be Similarly chargeable for having to pay back the loan, which implies you have got to be on the same site with all your co-applicant to make sure the loan is paid out off.

Scores and opinions are from actual customers which have used the lending lover’s providers. User ratings:

Jordan Tarver has spent seven several years masking house loan, own loan and small business financial loan material for leading money publications for instance Forbes Advisor. He blends know-how from his bachelor's degree in business finance, his encounter being a top rated performer inside the home finance loan industry and his entrepreneurial success to simplify sophisticated fiscal subject areas. Jordan aims to make mortgages and loans understandable.

Lending costs typically will increase or fall coupled with what the Fed does, so in the event you count on to possess a extended repayment expression, it might be a smart idea to wait right until later this calendar year or up coming year to have a private mortgage. The Fed is scheduled to fulfill once more April thirty–May well 1. Execs & Cons of Fast Personalized Loans

LendingPoint requires you to possess a credit rating score of no less than 660 to qualify for a personal personal loan. Additionally, you need to:

Being self-utilized doesn’t essentially necessarily mean you are able to’t get a personal loan. You might, even so, have to post added paperwork that don’t use to the borrower with a conventional position. These could incorporate revenue and reduction statements, organization and personal tax returns.

You may have a option amongst having your mortgage like a paper check or to be a immediate deposit. Choose direct deposit to Get the resources more rapidly.

This lender offers a number of kinds of loans, which includes personal-celebration vehicle loans. You would possibly even be capable of buy a car that isn’t still entirely paid off.

Of the non-public financial loan lenders that we reviewed, merely a portion manufactured the Lower. The lenders that didn’t have large adequate scores to be involved, gained reduced ratings resulting from having for a check here longer period funding occasions, greater curiosity charges, not making it possible for co-signers and charging a lot more fees than several competitors.

Individual loans are a versatile kind of credit history that may be accustomed to fork out for almost any purpose. Remember, your charges and conditions could depend on how you plan to employ The cash.

Prosper typically features individual loans for credit rating scores earlier mentioned 600. To be a bonus, Prosper allows for co-applicants, that means you are able to implement with someone else In case you have a credit rating score of below 600.

Based on Investopedia’s 2023 Private Personal loan Borrower survey, credit card debt consolidation is the most common reason individuals have taken out or want to get out own loans.

Captive funding is after you get your automobile bank loan straight from the automobile’s maker. Occasionally, these companies present 0% APR motor vehicle promotions (ordinarily all around holidays and the tip of the 12 months). There’s a caveat, even though — these deals commonly only use to specific cars.

No adverse alterations within your credit history report in the time Upstart approves you and when it disburses your funds

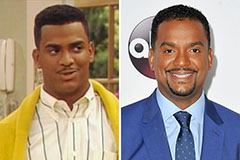

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Keshia Knight Pulliam Then & Now!

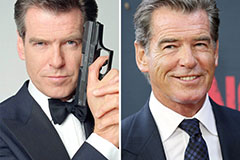

Keshia Knight Pulliam Then & Now! Pierce Brosnan Then & Now!

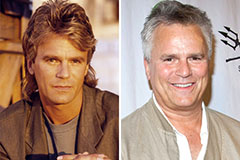

Pierce Brosnan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!